14

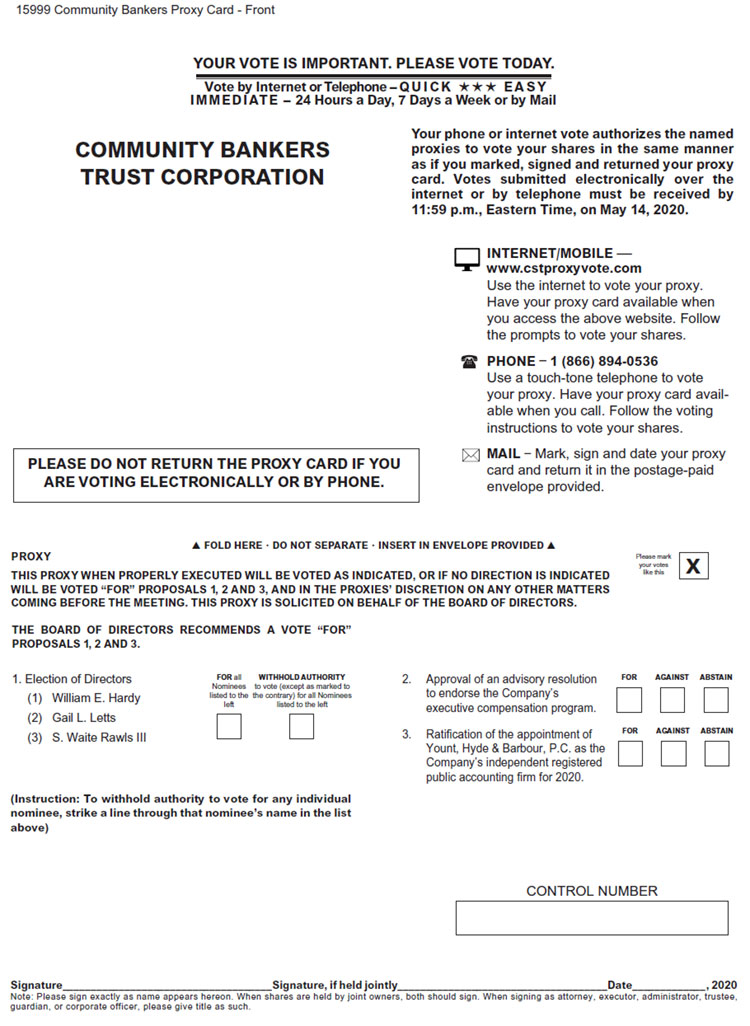

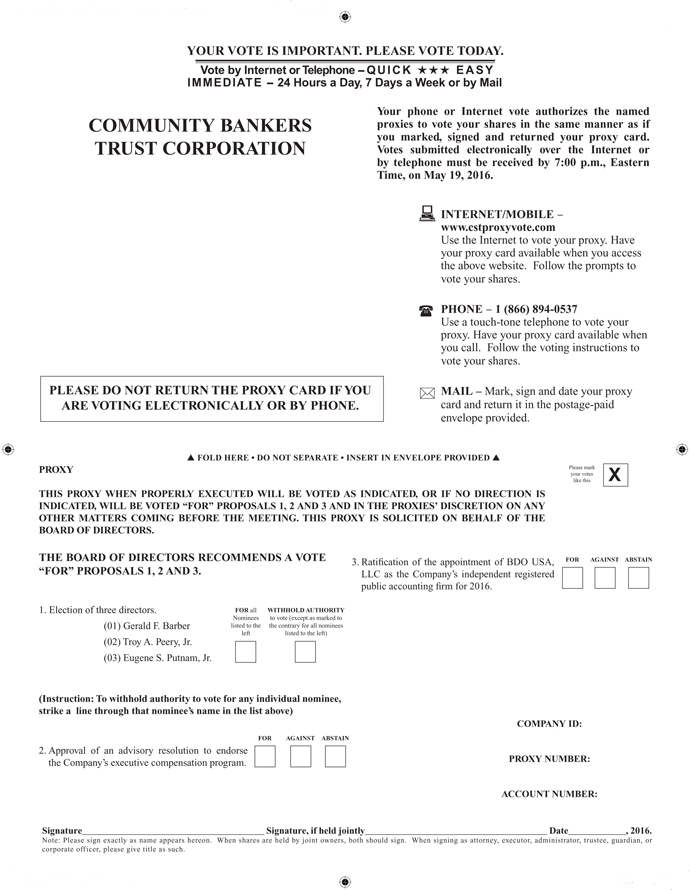

ELECTION OF DIRECTORS

General

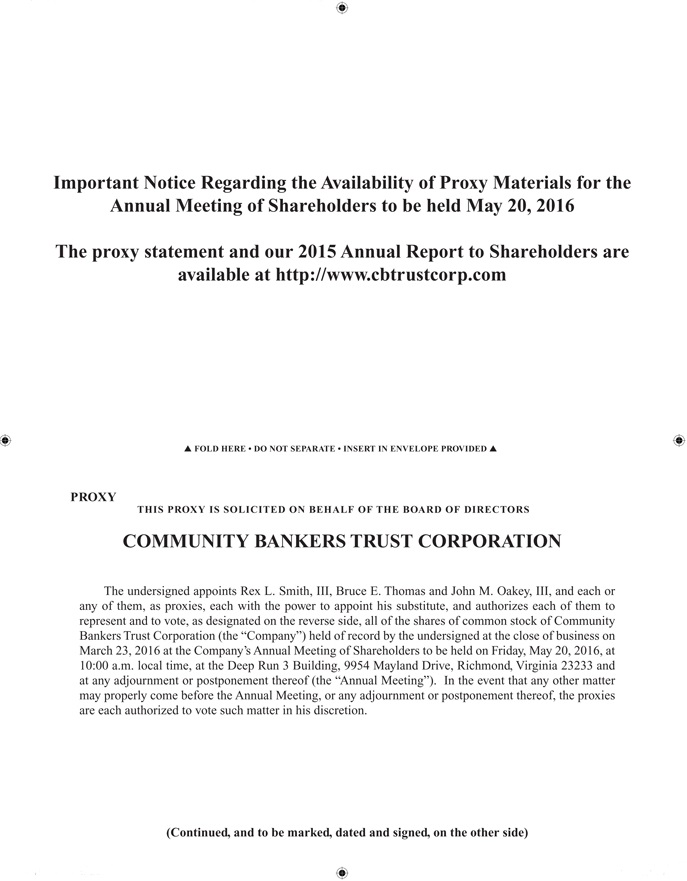

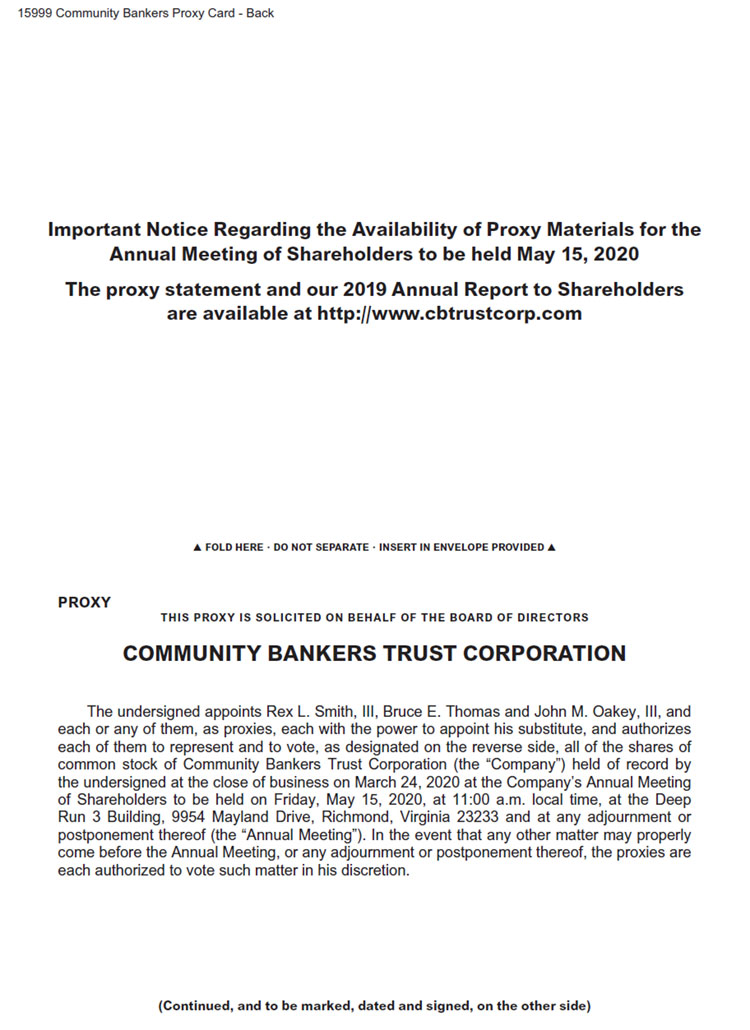

The Company’s Board of Directors currently consists of 1011 directors and is divided into three classes with staggered terms. The directors in Class I serve for a term that expires at the 2021 annual meeting of shareholders, the directors in Class II serve for a term that expires at the Annual Meeting,2022 annual meeting of shareholders and the directors in Class III serve for a term that expires at the 2017 annual meeting of shareholders and the directors in Class I serve for a term that expires at the 2018 annual meeting of shareholders.Annual Meeting.

The Board, upon the recommendation of the Nominating Committee, has nominated Gerald F. Barber, Troy A. Peery, Jr.William E. Hardy, Gail L. Letts and Eugene S. Putnam, Jr.Waite Rawls III for election to the Board at the Annual Meeting. All of the nominees presently serve as directors – the terms of Messrs. Hardy and their termsRawls will expire at the Annual Meeting.Meeting, and Ms. Letts, as a director appointed since the 2019 annual meeting of shareholders, is being presented to the shareholders for the first time. The Company is asking shareholders to elect the three nomineesMr. Hardy, Ms. Letts and Mr. Rawls for a three-year term that expires at the 20192023 annual meeting of shareholders.

The Board of Directors recommends that the shareholders voteFOR the election of Messrs. Barber, PeeryMr. Hardy, Ms. Letts and Putnam.Mr. Rawls. If you sign and return your proxy card in the enclosed envelope or execute a proxy by telephone or through the Internet,internet, the persons named in the enclosed proxy card will vote to elect these three nominees unless you indicate otherwise. Your proxy for the Annual Meeting cannot be voted for more than three nominees.

Each of the Company’s nominees has indicated the willingness to serve if elected. If any nominee of the Company is unable or unwilling to serve as a director at the time of the Annual Meeting, then shares represented by properly executed proxies will be voted at the discretion of the persons named in those proxies for such other person as the Board may designate. The Company does not presently expect that any of the nominees will be unavailable.

The election of each nominee for director requires the affirmative vote of the holders of a plurality of the shares of common stock voted in the election of directors. Thus, those nominees receiving the greatest number of votes cast will be elected.

The Company has adopted a “resignation for majority withhold vote” standard for the election of directors, as set forth in its Corporate Governance Guidelines. Any director that receives more “withhold” votes than “for” votes in an election will tender his or her resignation for consideration by the Board’s Nominating and Governance Committee and then the Board of Directors. The Company will publicly disclose the decision with respect to the tendered resignation and the reasons for the decision. A copy of the Corporate Governance Guidelines is available on the “Corporate Overview – Corporate Governance” page of the Company’s internet website atwww.cbtrustcorp.com.

The term of Richard F. Bozard as a Class III director expires at the Annual Meeting, and Mr. Bozard cannot stand for re-election under the age restrictions set forth in the Company’s Corporate Governance Guidelines. The Guidelines provide that a director not stand for re-election if the director is 73 or older at the end of his or her expiring term. The Company expresses its sincere gratitude to Mr. Bozard for his service as a director of TransCommunity Financial Corporation, which the Company acquired in 2008 (“TransCommunity Financial”), and its successors since 2006.

The following information sets forth the business experience for at least the past five years and other information for all nominees and all other directors whose terms will continue after the Annual

Meeting. Such information includes each director’s service on the boardsboard of TransCommunity Financial, Corporation, which the Company acquired on May 31, 2008 (“TransCommunity Financial”), and BOE Financial, as the case may be. References to a director’s service on the board of BOE Financial include service on the board of its predecessor, Essex Bank (which became a wholly owned subsidiary of the BOE Financial in 2000) (the “Bank”).2008.

Nominees for Election to a Three-Year Term (Class IIIII Directors)

Gerald F. BarberWilliam E. Hardy, 64, has been a director of the Company since March 2014.2017. Mr. BarberHardy is a finance professionalcertified public accountant with over 4035 years of accounting and auditing experience in the central Virginia market. He is a partner and the Chief Executive Officer of Harris, Hardy & Johnstone, P.C., an accounting auditing and consulting. He has worked with organizations of all sizes from start-up businesses to multi-national corporations and has delivered services to organizationsfirm in Richmond, Virginia, that he founded in 1987. Mr. Hardy’s expertise covers numerous industries, including banking, financial services, consumer/industrial products,hotels, real estate, manufacturing, construction contractors and wholesale and retail and technology. He was a Transaction Services Partner with PricewaterhouseCoopers LLP (“PwC”) from 2001 to 2012 and led the U.S. Latin America Transaction Services Practice in Washington, D.C. and Miami, Florida from 2004 to 2012. Since his retirement from PwC in 2012, Mr. Barber has continued advising both middle market and multi-national corporations. He served as an adjunct professor at the University of Virginia’s McIntire School of Commerce during 2012 and 2013.operations. He has been in the audit and accounting field since 1975.1983.

Mr. Barber brings extensive experience in the areas ofIn addition to his accounting and auditing mergers and acquisitions, financial services and management. He is a Certified Public Accountant.

Troy A. Peery, Jr., 69, has been a director of the Company since 2008 and served as Vice Chairman ofbackground, Mr. Hardy provides the Board from 2008 to 2011. He had previously served as a director of TransCommunity Financial since 2002. Mr. Peery has been President of Peery Enterprises, a real estate development company based in Manakin-Sabot, Virginia, since 1998.

Mr. Peery brings significant operational,with financial management and governance experience, including his prior service in executive management and as a director for Heilig-Meyers Company, Open Plan Systems, Inc. and S & K Famous Brands, Inc., all of which were public companies.insight into many diverse industries. He also has significant community ties to the Bank’s central Virginia market areas.

Eugene S. Putnam, Jr.Gail L. Letts, 56,67, has been a director of the Company since 2005 and served as its Chairman of the Board from 2005 to 2008. Mr. PutnamJune 2019. Ms. Letts has been President of Letts Consult, LLC, a business consulting firm in Richmond, Virginia, since June 2019. She also has over 35 years of experience as an executive in the banking industry, with a focus on strategic planning, financial and Chief Financial Officersales management, organizational transformation and revenue growth. Ms. Letts was Virginia Market President of Capital Bank, a Division of First Tennessee Bank, in Richmond, Virginia from 2015 to 2019. She was Richmond Region President and Head of Commercial Lending/Business Banking for Universal Technical Institute, Inc., a post-secondary education provider based in Scottsdale, Arizona, since 2011. He served as Executive ViceC&F Bank from 2013 to 2015. From 2007 to 2013, Ms. Letts was President and Chief Financial Officer for Universal Technical Institute, Inc. from 2008 to 2011, and he served as its interim Chief Financial Officer from January 2008 to July 2008. From 2005 to May 2007, Mr. Putnam was Executive Vice President and Chief Financial Officer of Aegis Mortgage Corporation, a mortgage originationthe Central Virginia Region of SunTrust Bank, and servicing company that filed for bankruptcy protection in August 2007.she has 30 years of experience with SunTrust Bank and its predecessors.

Mr. Putnam brings high level financial expertise as chief financial officer of publicly traded companiesMs. Letts has extensive executive experience overseeing teams providing retail banking, commercial banking, business banking and experience in risk managementwealth solutions to customers. She also led these teams, and strategic planning. He alsoassisted the banks for which she worked, through organizational change, cultural transformation and acquisition/growth expansion. Ms. Letts has banking expertise in corporate finance, capital planningsignificant professional and balance sheet management. His background helps him play critical roles on the Board’s committees.

Directors Whose Terms Do Not Expire This Year (Class I and Class III Directors)

Richard F. Bozard, 69, has been a directorcommunity ties throughout all of the Company since 2008. He had previously served as a director of TransCommunity Financial since 2006. Mr. Bozard was Vice President and Treasurer of Owens & Minor, Inc., a medical and surgical supplies distributor based in Mechanicsville, Virginia, from 1991 until his retirement in 2009. He had also been Senior Vice President and Treasurer of Owens & Minor Medical, Inc., a subsidiary of Owens & Minor, Inc., from 2004 until his retirement.

Mr. Bozard brings broad experience in the areas of management and oversight of public companies. He also has significant experience in asset and liability management, finance, strategic planning and mergers and acquisitions, which provides both the Board and management with a substantial resource, and thus he serves as Chair of the Board’s Asset and Liability Committee.

Glenn J. Dozier, 66, has been a director of the Company since 2011. Mr. Dozier was Chief Financial Officer for MolecularMD Corp., a molecular diagnostic and cancer drug clinical trial testing company based in Portland, Oregon, from 2009 until his retirement in 2015. He continues to serves as an executive consultant to MolecularMD Corp.

Mr. Dozier has more than 40 years of accomplishments in delivering strong management results in a wide variety of industries and environments. He also has provided successful leadership in general management, finance, strategic planning, human resources, property management and information systems. Mr. Dozier has served as the chief financial officer of several companies, including NYSE and NASDAQ traded companies, venture capital-backed firms and a Fortune 500 company, during his career. He has proven abilities in tactical and strategic financial functions.

P. Emerson Hughes, Jr., 72, has been a director of the Company since 2008. He had previously served as a director of BOE Financial since 2004. Mr. Hughes is Chairman of Holiday Barn, Ltd., a pet resorts and day care facility based in Richmond, Virginia, where he has been employed since 1972.

Mr. Hughes brings long-term corporate management experience as a small business owner. His experience also provides the Board and management a significant resource with respect to human resources, marketing and sales management. Mr. Hughes has knowledge of commercial business needs in the Bank’s central Virginia market areas, and he has significant community ties to those areas.markets.

S. Waite Rawls III, 67,71, has been a director of the Company since 2011. Mr. Rawls has beenwas President of the American Civil War Museum Foundation in Richmond, Virginia, from 2016 until his retirement in December 2019. He was Co-Chief Executive Officer of the American Civil War Museum in Richmond, Virginia, since 2013.from 2013 to 2016. He was President of the Museum of the Confederacy in Richmond, Virginia, from 2004 to 2013.

Mr. Rawls has numerous years of leadership positions in, among others, the technology, financial management and capital market fields, all of which underscore the insight that he has as a director. Mr. Rawls also has 18 years of working experience in the banking industry, serving as Vice Chairman of Continental Bank in Chicago, Illinois for four years and as Managing Director of Chemical Bank in New York, New York for 14 years. While the banking industry has changed, Mr. Rawls remains very familiar with the issues facing banks and the regulatory environment in which they operate.

Directors Whose Terms Do Not Expire This Year (Class I and Class II Directors)

Gerald F. Barber, 68, has been a director of the Company since 2014. Mr. Barber is a finance professional with over 40 years of experience in accounting, auditing and consulting. He has worked with organizations of all sizes from start-up businesses to multi-national corporations and has delivered services to organizations in numerous industries, including banking, financial services,

consumer/industrial products, retail and technology. He was a Transaction Services Partner with PricewaterhouseCoopers LLP (“PwC”) from 2001 to 2012 and led the U.S. Latin America Transaction Services Practice in Washington, D.C. and Miami, Florida from 2004 to 2012. Since his retirement from PwC in 2012, Mr. Barber has continued advising both middle market and multi-national corporations. He served as an adjunct professor at the University of Virginia’s McIntire School of Commerce during 2012 and 2013. He has been in the audit and accounting field since 1975.

Mr. Barber brings extensive experience in the areas of accounting and auditing, merger and acquisition transactions, financial services and management. He is a Certified Public Accountant.

Hugh M. Fain, III, 62, has been a director of the Company since 2018. Mr. Fain is President and a director of Spotts Fain PC, a law firm in Richmond, Virginia, where he has been a lawyer since 1992. He has over 35 years of experience as a civil trial attorney in a broad range of commercial and business matters. Mr. Fain’s representative clients include both public and private companies, as well as individual entrepreneurs, many of whom rely on him for general business counsel.

In addition to his strategic planning and management skills, Mr. Fain has been active with numerous organizations and provides the Board with expertise in corporate governance and fiduciary duties. He also has significant community ties to the Bank’s central Virginia market areas that support its business development initiatives.

Eugene S. Putnam, Jr., 60, has been a director of the Company since 2005 and served as its Chairman of the Board from 2005 to 2008. Mr. Putnam has been Chief Financial Officer for EVO Transportation & Energy Services, Inc., a nationwide transportation operator for the United States Postal Service and various freight shippers, since July 2019. He was President and Chief Financial Officer for Universal Technical Institute, Inc., a post-secondary education provider based in Scottsdale, Arizona, from 2011 to 2016. Mr. Putnam served as Executive Vice President and Chief Financial Officer for Universal Technical Institute, Inc. from 2008 to 2011.

Mr. Putnam brings high level financial expertise as chief financial officer of publicly traded companies and experience in risk management and strategic planning. He also has banking expertise in corporate finance, capital planning and balance sheet management. His background helps him play critical roles on the Board’s committees.

Rex L. Smith, III, 58,62, has been a director of the Company since 2011. Mr. Smith has been President and Chief Executive Officer of the Company and the Bank since 2011. He served as the Bank’s Executive Vice President and Chief Banking Officer from 2010 to 2011, and he held the responsibilities of President and Chief Executive Officer of the Company and the Bank, including serving as Executive Vice President of the Company, for eight months in 2010 and 2011. From 2009 to 2010, he was the Bank’s Executive Vice President and Chief Administrative Officer. From 2007 to 2009, he was the Central Virginia President for Gateway Bank and& Trust and, from 2000 to 2007, he was President and Chief Executive Officer of The Bank of Richmond.

Mr. Smith has 35approximately 40 years of experience in the banking industry and a unique perspective from the management experiences that he has had with different banks. He is also intimately aware of the particular opportunities and challenges facing the Company and the Bank, as he has been a member of executive management for seven10 years.

John C. Watkins, 69,73, has been a director of the Company since 2008 and has served as Chairman of the Board since 2011. He had previously served as a director of TransCommunity Financial and its predecessor, Bank of Powhatan, N.A., since 1998. Senator Watkins was President of Watkins

Nurseries, Inc., a landscape design firm and wholesale plant material grower based in Midlothian, Virginia, from 1998 to 2008, and he currently serves as the Chairman of its board of directors.2008. He has also been Manager and Development Director for Watkins Land, LLC, a real estate company based in Midlothian, Virginia, since 1999. He was a member of the Virginia House of Delegates from 1982 to 1998, and a member of the Senate of Virginia from 1998 to 2016 and a member of the Powhatan County Economic Development Authority since 2016.

Senator Watkins brings long-term corporate management experience as a small business owner and entrepreneur, through his ownership and operation of successful businesses in the Company’s market areas. He also brings substantial government and public policy expertise and leadership knowledge to the Company due to his long service in the Virginia state government. He has significant community ties to the Bank’s central Virginia market areas.

Oliver L. Way, 67, has been a director of the Company since 2018. From 2005 until his retirement in 2018, Mr. Way was Executive Vice President and Virginia Markets Regional President of Fulton Bank, N.A., the banking subsidiary of Fulton Financial Corporation based in Lancaster, Pennsylvania. At Fulton Bank, he oversaw banking operations, planning and strategic initiatives in its Virginia markets. Mr. Way has over 40 years’ experience in the financial services industry, including 23 years with Wachovia Bank and its predecessor, Central Fidelity Bank.

Mr. Way brings many years of experience and expertise in leadership, business development, risk management and credit analysis. He also has significant community and financial industry ties to the Bank’s central Virginia market areas.

Robin Traywick Williams, 65,69, has been a director of the Company since 2008. She had previously served as a director of TransCommunity Financial since 2002. Mrs. Williams is a writer and, from 2009 to 2011, she served as president of the Thoroughbred Retirement Foundation. From 1998 to 2003, she served as Chairman of the Virginia Racing Commission in Richmond, Virginia.

Mrs. Williams brings regulatory and governance leadership to the Board through her experience with Virginia government and regulatory agencies and community organizations. She also has significant community ties to the Bank’s central Virginia market areas.

The Company’s executive officers as of March 23, 2016 and their respective ages and positions are set forth in the following table.

Name | Age | Position |

| Rex L. Smith, III | 62 | President and Chief Executive Officer Community Bankers Trust Corporation and Essex Bank |

| Bruce E. Thomas | 56 | Executive Vice President and Chief Financial Officer Community Bankers Trust Corporation and Essex Bank |

| Jeff R. Cantrell | 57 | Executive Vice President and Chief Operating Officer Essex Bank |

Name | Age | Position | ||

54 | Executive Vice President and Chief | |||

| John M. Oakey, III | Executive Vice President, General Counsel and Secretary Community Bankers Trust Corporation and Essex Bank | |||

| William E. Saunders, Jr. | Executive Vice President and Chief Risk Officer Essex Bank | |||

The following information sets forth the business experience for at least the past five years and other information for the executive officers. Such information with respect to Mr. Smith is set forth above in the “Proposal One – Election of Directors” section.

Mr. Thomas has been Executive Vice President and Chief Financial Officer of the Company since 2010, and he was Senior Vice President and Chief Financial Officer of the Company from 2008 to 2010. From 2000 to 2008, he was Senior Vice President and Chief Financial Officer of BOE Financial.Financial Services of Virginia. Inc., which the Company acquired in 2008 (“BOE Financial”). He has been employed in various positions with the Bank since 1990.

Mr. Cantrell has been the Bank’s Executive Vice President and Chief Operating Officer since 2012, and he was the Bank’s Senior Vice President and Senior Financial Officer from 2009 to 2012. From 2008 to 2009, he was Executive Vice President, Chief Financial Officer and Chief Operating Officer for North Metro Financial LLC, the organizational entity for a bank in organization in Georgia. From 1984 to 2008, he was employed with Regions Bank, where he most recently served in the position of Senior Vice President and East Region Financial Manager.

Ms. Davis has been the Bank’s Executive Vice President and Chief Credit Officer since 2014. From 2011 to 2014, she served as the Bank’s Senior Vice President and Senior Credit Officer. From 2009 to 2011, she served as the Bank’s Loan Review Officer. Ms. Davis has over 30 years of experience in the banking industry, over 18 of which have been in credit risk management, including executive management roles at First Charter Bank in Charlotte, North Carolina, which was acquired by Fifth Third Bank in 2008.

Mr. Oakey has been General Counsel and Secretary of the Company and the Bank since 2009, with the titles of General Counsel since 2010 and Senior Legal Counsel from 2009 to 2010. He was named Executive Vice President in 2011. From 2007 to 2009, he was Director and Assistant General Counsel for Circuit City Stores, Inc. Until 2007, he was a partner at the law firm of Williams Mullen, where he began practicing in 1995.

Mr. Saunders has been the Bank’s Executive Vice President and Chief Risk Officer since 2011. From 2010 to 2011, he served as the Bank’s Executive Vice President and Chief Operating Officer. From 2008 to 2010, he served as the Bank’s Senior Vice President – Chief Risk Officer. From 2004 to 2008, he was the Bank’s Vice President – Risk Management. Mr. Saunders has 3033 years of experience in the banking industry, including experience with regulatory work, audit and operations.

Ms. Vogel has been the Bank’s Executive Vice President and Chief Credit Officer since 2014. From 2011 to 2014, she served as the Bank’s Senior Vice President and Senior Credit Officer. From 2009 to 2011, she served as the Bank’s Loan Review Officer. Ms. Vogel has over 27 years of experience in the banking industry, the last 15 of which have been in credit risk management, including executive management roles at First Charter Bank in Charlotte, North Carolina, which was acquired by Fifth Third Bank in 2008.

Compensation Committee Report

The Compensation Committee of the Board of Directors reviews and establishes the compensation program for the Company’s senior management, including the named executive officers in the Summary Compensation Table below, and provides oversight of the Company’s compensation program. A discussion of the principles, objectives, components, analyses and determinations of the Committee with respect to executive compensation is included in the Compensation Discussion and Analysis that follows this Committee report. The Compensation Discussion and Analysis also includes discussion with respect to the Committee’s review of officer and employee compensation plans and specifically any features that may encourage employees to take unnecessary and excessive risks. The specific decisions of the Committee regarding the compensation of the named executive officers are reflected in the compensation tables and narrative that follow the Compensation Discussion and Analysis.

The Compensation Committee certifies that:

(1) it reviewed with the senior risk officerChief Risk Officer the senior executive officer compensation plans and made all reasonable efforts to ensure that these plans do not encourage the senior executive officers to take unnecessary and excessive risks that threaten the value of the Company;

(2) it reviewed with the senior risk officerChief Risk Officer the employee compensation plans and made all reasonable efforts to limit any unnecessary risks these plans pose to the Company; and

(3) it reviewed the employee compensation plans to eliminate any features of these plans that would encourage the manipulation of reported earnings of the Company and the Bank to enhance the compensation of any employee.

The Committee has reviewed the Compensation Discussion and Analysis and discussed it with the Company’s management. Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s annual report on Form 10-K for the year ended December 31, 20152019 and the Company’s 20162020 proxy statement.

Compensation Committee

Eugene S. Putnam, Jr., Chair

Troy A. Peery, Jr.Hugh M. Fain, III

Gail L. Letts

John C. Watkins

Date: April 11, 2016

3, 2020

Compensation Discussion and Analysis

General

The Compensation Committee of the Company’s Board of Directors reviews and establishes the compensation program for the Company’s senior management, including the named executive officers in the Summary Compensation Table below, and provides oversight of the Company’s compensation program. The Committee consists entirely of non-employee, independent members of the Board and operates under a written charter approved by the Board.

The Committee specifically discharges Board oversight responsibilities with respect to

| the compensation of the Company’s Chief Executive Officer and other executive officers and |

| the administration of incentive compensation plans, including stock plans and short- and long-term incentive compensation plans; and |

| the approval, review and oversight of certain retirement and other benefit plans of the Company. |

The Company’s compensation program generally consists of salary, annual cash bonus and incentives, equity-based long-term compensation and pre-and post-retirement benefits. Benefits include participation in the Company’s 401(k) plan and health insurance benefits. The Company also has a defined benefit pension plan, which has been frozen, and a supplemental retirement plan, which has been frozen to new entrants. TheIn 2016, the Company intends to implement in 2016, as discussed below,established a non-qualified defined contribution retirement plan for and executed change in control agreements with the named executive officers. In addition, the Company offers perquisites to certain executive officers such as use of Company-owned vehicles.

The Company recognizes that competitive compensation is critical for attracting, motivating, rewarding and retaining qualified executives. One of the fundamental objectives of the Company’s compensation program is to offer competitive compensation and benefits for all employees, including executive officers, in order to compete for and retain talented personnel who will lead the Company in achieving levels of financial performance that enhance shareholder value. The Company also recognizes the importance of setting compensation levels in line with the Company’s overall performance.

The Company’s overall operating strategy is to be recognized as the premier provider of financial services by exceeding the service expectations of its customers and shareholders while creating a rewarding environment for its employees. The Company has adopted and implemented a formal strategic plan that centers on ensuring profitable controlled growth in earnings, improving the overall risk profile of the Company through enterprise risk management and solidifying strong management practices with a focus on value added. These efforts require a strong and dedicated management team focused on strategic growth for the franchise, through both internal loan growth and appropriate branch and market development. This growth likewise requires a management team with relevant experience. As a result, a primary focus of the Company’s compensation program has been, and continues to be, to attract and retain a team of experienced bankers.

As discussed below, the Committee has engaged Matthews Young – Management Consulting as the independent consultant to assist it in carrying out certain responsibilities with respect to executive compensation. Matthews Young satisfies the standards that the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) established, and that the Nasdaq Stock Market adopted, with respect to the independence of compensation consultants.

The following discussion explains the material elements of compensation paid to the Company’s named executive officers and provides the material factors underlying its compensation policies and practices. The information in this discussion specifically provides context for the compensation disclosures in the tables that follow it and should be read along with those disclosures.

Compensation Program

The current components of the Company’s compensation program represent the elements that the Company has offered in the past in order to attract, motivate, reward and retain highly qualified executive officers. The Company believes that these elements are also standard compensation components of its peer companies and allow the Company to present an attractive compensation package to each of its named executive officers in comparison with these companies.

The Committee approves the compensation of all members of senior management, including the named executive officers. In making its determinations, the Committee has detailed discussions with

both its compensation consultant and the Chief Executive Officer on appropriate levels of compensation, primarily in the context of therelevant peer group data, for the Company and the specific positions of its senior officers. In addition, the Committee evaluates not only each component of compensation, as discussed further below, but also the overall total package of compensation for each senior officer.

In connection with its annual approvals, the Committee reviews, with the Company’s Chief Risk Officer, all components of the Company’s compensation program. Following the review in January 2016, theThe Committee has determined that none of these components contain any feature that would encourage the senior officers to take unnecessary and excessive risks that would threaten the value of the Company. In addition, the Committee has determined that there is no element in any senior management or other employee compensation plan that would encourage the senior officers or employees to manipulate reported earnings in order to enhance compensation.

Bruce E. Thomas, the Company’s Executive Vice President and Chief Financial Officer, had an employment agreement with the Company during 2015. A summary of the agreement is set forth below following the Summary Compensation Table. No other executive officers had an employment agreement with the Company during 2015.

The following information discusses the compensation decisions for the named executive officers for the 20152019 year supplemented by the same decisions for the 2016 year.and in early 2020.

Salary

The base salary of the named executive officers is designed to be competitive with that of the Company’s peer banks, as described further below. In establishing the base salary for the named executive officers, the Committee relies on an evaluation of the officers’ level of responsibility and performance and on comparative information. In establishing the base salary, other than for the Chief Executive Officer, the Committee also receives and takes into account the individual compensation recommendations from the Chief Executive Officer. The salary of the Chief Executive Officer is also approved by the independent members of the Board of Directors, upon recommendation of the Committee.

In January 2015,2019, the Committee reviewed and determined salaries for the 20152019 year. The Committee received and reviewed recommendations from Mr. Smith for increases in salaries for the other named executive officers. The Committee considered the reasons for the proposed increases, including the value that each officer has contributed to the Company and Mr. Smith’s desire to keep salaries in line with the mid-range of the Company’s peer group, based on updated peer group information prepared by the Committee’s compensation consultant. The peer group data that the Committee reviewed for 2015 salaries was derived from a peer group of 26 comparably-sized, publicly reporting financial institutions in Virginia, Kentucky, Maryland, North Carolina and Tennessee. Members of the peer group included:

As a result, the Committee determined to make, at Mr. Smith’s recommendation, the salary increases for the named executive officers as set forth below effective as of January 1, 2015.

| Name | 2014 Salary | 2015 Salary | ||||||

| Bruce E. Thomas | $ | 191,000 | $ | 198,000 | ||||

| Jeff R. Cantrell | $ | 191,000 | $ | 198,000 | ||||

| John M. Oakey, III | $ | 191,000 | $ | 198,000 | ||||

| Patricia M. Vogel | $ | 175,000 | $ | 182,000 | ||||

Also in January 2015, the Committee reviewed and determined a salary for Mr. Smith for the 2015 year. The Committee considered the financial performance of the Company during 2014 from the standpoint of both earnings and credit quality. The Committee also considered reasons for an increase, including the value that Mr. Smith’s performance and service contributed to the Company in 2014 and expectations for 2015. The Committee acknowledged its desire to continue to keep his salary in line with the Company’s peer group, consistent with the other executive officers of the Company. As a result, the Committee approved a salary increase for Mr. Smith from $375,000 to $390,000, effective January 1, 2015, and this increase was subsequently approved by the Board of Directors.

In January 2016, the Committee reviewed and determined salaries for the 2016 year. As it did thein previous year,years, the Committee received and reviewed recommendations from Mr. Smith for increases in salaries for the other named executive officers. The Committee considered the reasons for the proposed increases, including the value that each officer has contributedcontinued to the Company andconsider Mr. Smith’s desire to keep salaries in line with the mid-range level of the Company’s peer group, basedwith an added emphasis for 2019 on updatedcost of living adjustments, and supplemented more by the performance-based annual incentives. The peer group information prepared by the Committee’s compensation consultant. This information included only current salary range averages and did not include the names of any banks included in thedata was derived from a peer group which was comprised of bankspublicly reporting financial institutions of similar asset size to the Company and in or close to the Company’s market area. The information that the Committee reviewed for the 2019 year included only salary range averages from that data and did not include the names of any banks included in the peer group. Mr. Smith also recommended that each of Mr. Cantrell and Ms. VogelDavis receive a slightly higher percentage increase in salary in order to be closer in line with the peer group data for her position, due to her service time as Chief Credit Officer.and with internal salary levels. As a result, the Committee determined to make, at Mr. Smith’s recommendation and supported by the peer group data, the salary increases for the named executive officers as set forth below effective as of January 1, 2016.2019.

| Name | 2018 Salary | 2019 Salary | Percentage Increase | ||||||||||

| Thomas | $ | 215,000 | $ | 219,000 | 1.86 | % | |||||||

| Cantrell | $ | 215,000 | $ | 220,000 | 2.33 | % | |||||||

| Davis | $ | 203,000 | $ | 210,000 | 3.45 | % | |||||||

| Oakey | $ | 215,000 | $ | 219,000 | 1.86 | % | |||||||

| Name | 2015 Salary | 2016 Salary | ||||||

| Bruce E. Thomas | $ | 198,000 | $ | 204,000 | ||||

| Jeff R. Cantrell | $ | 198,000 | $ | 204,000 | ||||

| John M. Oakey, III | $ | 198,000 | $ | 204,000 | ||||

| Patricia M. Vogel | $ | 182,000 | $ | 190,000 | ||||

Also in January 2016,2019, the Committee reviewed and determined a salary for Mr. Smith for the 20162019 year. The Committee considered the financial performance of the Company during 20152018 from the standpoint of both earnings, credit quality and credit quality.overall operational performance. The Committee also considered reasons for an increase, including the value that Mr. Smith’s performance and service contributed to the Company in 20152018 and expectations for 2016.2019. The Committee acknowledged its desire to continue to keep his salary in line with the Company’s peer group, consistent with the other executive officers of the Company, with an added emphasis on cost of living adjustments, and supplemented more by the performance-based annual incentives. As a result, the Committee approved a salary increase for Mr. Smith from $420,000 to $427,500 (a 1.79% increase), effective January 1, 2019, and this increase was subsequently approved by the Board of Directors.

In January 2020, the Committee reviewed and determined salaries for the 2020 year. As it did the previous year, the Committee received and reviewed recommendations from Mr. Smith for increases in salaries for the other named executive officers. The Committee continued to consider Mr. Smith’s desire to keep salaries in line with the mid-range level of the Company’s peer group, and with the Company’s budget in light of lower general economic and financial expectations for the year. The peer group data was updated for the 2020 salary determinations, but it again included only salary range averages from that data and did not include the names of any banks included in the peer group. Mr. Smith recommended that Ms. Davis receive a slightly higher percentage increase in salary in order to be in line with the peer group data and with internal salary levels, and due to additional departmental oversight responsibilities. As a result, the Committee determined to make, at Mr. Smith’s recommendation and supported by the peer group data, the salary increases for the named executive officers as set forth below effective as of January 1, 2020.

Name | 2019 Salary | 2020 Salary | Percentage Increase | ||||||||||

| Thomas | $ | 219,000 | $ | 222,500 | 1.60 | % | |||||||

| Cantrell | $ | 220,000 | $ | 223,500 | 1.59 | % | |||||||

| Davis | $ | 210,000 | $ | 220,000 | 4.76 | % | |||||||

| Oakey | $ | 219,000 | $ | 222,500 | 1.60 | % | |||||||

Also in January 2020, the Committee reviewed and determined a salary for Mr. Smith for the 2020 year. The Committee considered the financial performance of the Company during 2019 from the standpoint of earnings, credit quality and overall operational performance. The Committee also considered reasons for an increase, including the value that Mr. Smith’s performance and service contributed to the Company in 2019 and expectations for 2020. The Committee acknowledged its desire to continue to keep his salary in line with the Company’s peer group and recognized expectations for the year consistent with the other executive officers of the Company. As a result, the Committee approved a salary increase for Mr. Smith from $390,000$427,500 to $402,000,$434,000 (a 1.52% increase), effective January 1, 2016,2020, and this increase was subsequently approved by the Board of Directors.

Annual Incentives

The Committee believes that executive compensation should be meaningfully linked to the Company’s performance. Accordingly, the Company annually adopts an objectives-based incentive plan for the Company’s named executive officers that ties incentive payments to specific operating metrics of the Company. The Committee carefully reviews operating metrics that Mr. Smith has recommended in order to select those metrics that drive growth and earnings and thus overall shareholder value.

For the 20152019 year, thesethe metrics in the incentive plan were net income, the amount of non-performing assets as a percentage of total assets at 20152019 year end and a job-related discretionary component; the three metrics were assigned weights of 70%80%, 20%10% and 10%, respectfully. The plan included threshold, target, stretch and maximum levels of performance for each metric and a corresponding payout, weighted as a percentage of salary, to each of the named executive officers based on the achievement of such levels. The range ofa specific level, as set forth in the payout on each metric for the named executive officers other than Mr. Smith, weighted as noted above, would be generally from 5.0% (threshold) to 25.0% (maximum) of salary, and the range of the payout for Mr. Smith would be from 7.5% (threshold) to 37.5% (maximum) of salary (that is, 50% higher in percentage). following table.

| Level | Operating Metric Achievement | Proportionate Percentage Payout | |||

| Threshold | Annual budgeted amount | Smith | 7.5% of salary | ||

| Other NEOs | 5.0% of salary | ||||

| Target | Annual budgeted amount plus 5.0% | Smith | 15.0% of salary | ||

| Other NEOs | 10.0% of salary | ||||

| Stretch | Annual budgeted amount plus 10.0% | Smith | 22.5% of salary | ||

| Other NEOs | 15.0% of salary | ||||

| Maximum | Annual budgeted amount plus 15.0% | Smith | 37.5% of salary | ||

| Other NEOs | 25.0% of salary | ||||

The net income metric was the performance measure that drove the plan, and thus the proportionate percentage payouts for each of the other two measures could not exceedthree operating metrics was determined by the proportionate percentage payout forlevel that the net income metric. Accordingly, if the performanceCompany achieved with respect to the net income metric had not metin 2019. In addition, the threshold level, there would have been no payout at all under the incentive plan.proportionate percentage payouts were prorated between metric achievement levels.

For 2015,2019, each of the Company’s net income following certain adjustments, exceeded the target amount (but did not meet the stretch or maximum amounts) under the plan, which corresponded to a 70% weighted payout of 10% of salary, and the amount of non-performing assets as a percentage of total assets likewise exceededwere between the target amount (but did not meetand the stretch or maximum amounts), which corresponded to a 20% weighted payout of 10% of salary.amount. Mr. Smith recommended an additional oneone-and-a-half percent of salary for the named executive officers with respect to the job-related discretionary component under the plan. As a result, on January 21, 2016,16, 2020, the Committee approved incentive awards to the Company’s executive officers (other than Mr. Smith) under the 20152019 annual incentive plan, in the aggregate amount of 10%13.50% of salary, as follows.set forth in the following table.

| Name | 2015 Incentive Award | |||

| Bruce E. Thomas | $ | 19,800 | ||

| Jeff R. Cantrell | $ | 19,800 | ||

| John M. Oakey, III | $ | 19,800 | ||

| Patricia M. Vogel | $ | 18,200 | ||

| Name | 2019 Incentive Award | ||||

| Thomas | $ | 29,565 | |||

| Cantrell | $ | 29,700 | |||

| Davis | $ | 28,350 | |||

| Oakey | $ | 29,565 | |||

On January 22, 2016,17, 2020, the Board of Directors, upon the recommendation of the Committee, approved an incentive award to Mr. Smith in the amount of $58,500 (15%$86,569 (20.25% of salary) under the 20152019 annual incentive plan, due to the achievement of the performance metrics set forth in the 2015 annual incentivethat plan, as discussed above.

For the 20162020 year, the Company has adopted an incentive plan for the named executive officers that is similar in structure to the plan for the 20152019 year. The 20162020 plan retains the same three metrics asfrom the 20152019 plan (net income, asset quality and the job-related discretionary component), whichand adds a transaction deposit growth metric). The four metrics have been assigned weights of 75%70%, 10% and 10%5%, respectively, for the repeating metrics and adds a fourth metric – non-interest-bearing15% for the new deposit growth, which has been assigned a weight of 5%.metric. The range of the payout for Mr. Smith and

the other named executive officers remains the same as the 2015 plan. The range for the named executive officers other than Mr. Smith, weighted2019 plan, as noted above, will be generally from 5.0% (threshold) to 25.0% (maximum) of salary, andin the range for Mr. Smith will be from 7.5% (threshold) to 37.5% (maximum) of salary. As with the 2015 plan, the net income metric will be the performance measure that drives the 2016 plan, and thus the proportionate percentage payouts for each of the other three measures cannot exceed the proportionate percentage payout for the net income metric. Accordingly, if performance with respect to the net income metric does not meet the threshold level, there will be no payout at all under the incentive plan.table above. The Board of Directors of the Company approved this plan on January 22, 2016.17, 2020.

The Committee has discussed the implementation of a clawback policy that provides forconsiders, as appropriate, the recovery of incentive-based compensation that should not have been awarded in the event of a future restatement of financial results or similar event. The Committee intends to adoptCompany’s 2019 Stock Incentive Plan expressly includes such a policy that is consistent with the requirements that the Securities and Exchange Commission is currently in the process of mandating for stock exchange listing standards under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.clawback policy.

Long-Term Incentives

In 2009, theThe Company adopted and its shareholders approvedmaintains the Community Bankers Trust Corporation 2009 Stock Incentive Plan.Plan, which terminated on June 17, 2019, and the Community Bankers Trust Corporation 2019 Stock Incentive Plan, which was approved by shareholders on May 17, 2019. The purpose of the 2019 plan is the same as the purpose of the 2009 plan and is to further the long-term stability and financial success of the Company by attracting and retaining employees and directors through the use of stock incentives and other rights that promote and recognize the financial success and growth of the Company. The Company believes that ownership of Company stock will stimulate the efforts of such employees and directors by further aligning their interests with the interests of the Company’s shareholders. The 2019 plan is tocan be used (and before its termination the 2009 plan was used) to grant restricted stock awards, stock options in the form of incentive stock options and non-statutory stock options stock appreciation rights and other stock-based awards to employees and directors of the Company. As adopted,The 2009 plan made available up to 2,650,000 shares of common stock for issuance to participants under the plan, and the 2019 plan makes available up to 2,650,0002,500,000 shares of common stock for issuance to participants under the plan.

The Committee has consideredconsiders specifically awards of restricted stock and stock options to the named executive officers and the benefits and disadvantages of each type of award to both the Company and the officer. The Committee believes that stock options have been the most effective type of award for the purposes of its compensation program in recent years as the Company’sin order to align management interests with shareholder interests by rewarding long-term stock price has been considered to be undervalued.appreciation.

In January 2015,2019, the Committee approved stock option awards to the named executive officers. In taking these actions, the Committee considered recommendations from both the Chief Executive Officer (except with respect to his award) and the Committee’s compensation consultant with respect to the form of the award and the amounts. In determining the specific amounts for the stock option awards, the Committee considered that such awards would motivate individual long-term performance. In addition, the exercise price for each stock option award was set at a price equal to the common stock’s closing sales price on the date of the award. The specific amounts of the awards for the named executive officers are set forth in the “Grants of Plan-Based Awards” table on page 2930 below. The Committee granted stock option awards to 2238 employees, including the named executive officers, in January 2015.2019.

In January 2016,2020, the Committee approved stock option awards to the named executive officers. In taking these actions, the Committee considered recommendations from both the Chief Executive Officer (except with respect to his award) and the Committee’s compensation consultant with respect to the form of the award and the amounts. The award granted to each of Messrs. Thomas, Cantrell and Oakey and Ms. VogelDavis was an option to acquire 20,000 shares of common stock. In addition, the Committee reviewed a proposed award for Mr. Smith and considered a level that would be consistent with peer group data from the standpoint of a total compensation package in line with Mr. Smith’s years of service to the Company. As a result, at the recommendation of the Committee, the Board approved for Mr. Smith a stock option award to acquire 40,000 shares of common stock. In determining the specific amounts for the stock option awards, the Committee considered that such awards would motivate individual long-term performance. The Committee granted stock option awards to 2243 employees, including the named executive officers, in January 2016.2020.

In the future, the Company expects that any stock option grants and restricted stock awards to executive officers and other key employees will be approved at regularly scheduled Committee meetings, and subsequently approved by the Board of Directors. The Company’s Chief Executive Officer will provide the Committee with a recommendation concerning the recipients (other than himself), the reason for the award and the number of shares to be awarded. The grant date will generally be the date of the meeting at which the Board approves awards presented by the Committee. The Company will not tie the timing of the issuance of stock options or restricted stock awards to the release or withholding of material non-public information.

Retirement Program

The Company’s predecessors maintainedCompany believes that a meaningful retirement programsprogram, one that had beenis designed to provide executive officers with an appropriate level of financial security and income, following retirement, relative to their pre-retirement earnings. The Company continued to maintain a retirement program that it inherited, and the program historically had been reflective of common practices among companies of similar size and structure. The Company believes that a meaningful retirement programearnings, is a valuable tool in attracting and retaining highly qualified employees. To date, however, the Company does not believe that its program has adequately served that purpose.

During 2015, the components of theThe Company’s retirement program includedincludes four components, including the following:following three components that have been in place since its acquisition of BOE Financial and TransCommunity Financial:

| a 401(k) employee savings plan for which all full-time employees who are 21 years of age or older are eligible to participate (all of the named executive officers are participants) |

| a non-tax qualified Supplemental Executive Retirement Plan, inherited from BOE Financial, for certain executives to supplement the benefits that such executives can receive under other retirement program components and social security (of the named executive officers, only Mr. Thomas is a participant) |

| a noncontributory defined benefit pension plan, inherited from BOE Financial and frozen to new entrants, for all full-time employees who were 21 years of age or older and who had completed one year of eligibility service (of the named executive officers, only Mr. Thomas is a participant) |

Additional information with respectIn establishing a full compensation program for executive officers, the Committee recognized that the retirement program prior to these three2016 did not adequately serve the purpose of attracting and retaining highly qualified employees. In particular, the Committee acknowledged that four of the Company’s six executive officers were only participants in one of the retirement program’s components, is set forth in the “Post-Employment Compensation” section below.401(k) employee savings plan.

In 2016,response to the limitations of the retirement program, the Company intends to implementimplemented in 2016 a non-qualified defined contribution retirement plan for its named executive officers. The purpose of the plan will beis to enhance the retirement benefits that the Company provides to each named executive officer and to recognize each officer for overall performance through additional incentive-based compensation. TheAs noted earlier, the Committee believes that executive compensation should be meaningfully linked to the Company’s performance. Accordingly, the plan will beis a performance driven plan, and the Company will makemakes contributions to the plan on a discretionary basis based on payouts under the Company’s annual incentive plan, which in turn is based on the achievement of various performance metrics that the Company establishes through the Committee. For 2016, those metrics will beCommittee, as discussed above. The plan is unfunded and unsecured.

Additional information with respect to the same metricscomponents of the Company’s retirement program, including the value of participant’s accounts, is set forth in the 2016 annual incentive plan for the named executive officers, as noted above. The plan will be unfunded and unsecured.“Post-Employment Compensation” section on page 32 below.

Perquisites and Fringe Benefits

Perquisites and fringe benefits are designed to provide certain personal benefits and to fund certain expenditures that are common among executive officers in many companies. The Committee believes that this component of compensation is a valuable tool in attracting, motivating, rewarding and recruiting highly qualified employees. The Committee reviews the level of these benefits on an annual basis.

The Company provides each of Mr. Smith and Mr. Thomas with the use of a company automobile. The employment agreement with Mr. Thomas provides for an automobile or automobile allowance, with appropriate insurance coverage and maintenance expenses, and for the payment or reimbursement for country club dues that may be incurred. The Company provides Mr. Cantrell with an automobile allowance.

Post-Termination Compensation

Under his employment agreement, Mr. Thomas may be entitled to post-termination compensation in certain cases. The provisionsCompany is aware of this agreement are detailed furtherconstant opportunities for mergers and quantifiedother consolidations in the section below titled “Post-Employment Compensation.”banking industry, and the Board of Directors encourages management to seek out such opportunities that are in the best interest of shareholders. The Committee is also mindful of the inherent difficulty that management may have in pursuing opportunities that could result in the loss of their jobs.

The Company does not currently have any other agreements that provide for post-termination compensation. In order to support management in such strategic endeavors, in 2016, the Company intends to provideprovided each of the named executive officers with a change-in-controlchange in control agreement with terms and pay-outs consistent with both the officer’s position and responsibilities and similar arrangements in place at the Company’s peer banks. Any pay-outs from such an agreement, and other compensation that the officer may receive under other Company plans, will be subject to the limitations of Section 280G of the Internal Revenue Code Section 280G.of 1986, as amended (the “IRC”). The Company’s currenthistorical compensation arrangements dohave not provideprovided for the Company to make “gross-up” payments that would cover the reimbursement of excise taxes that may arise under Section 280G. The Company intends that280G, and accordingly each change-in-controlchange in control agreement similarly willdoes not contain such a “gross-up” provision.

Additional information with respect to the Company’s change in control agreements is set forth beginning on page 34 below.

Summary Compensation Table

The table below sets forth, for the years ended December 31, 2015,2019, December 31, 20142018 and December 31, 2013,2017, the compensation earned by the following named executive officers:

| the individuals who served as the Company’s principal executive officer and the principal financial officer during |

| the three other most highly compensated executive officers who were executive officers at December 31, |

| Name and Principal Position | Year | Salary ($) | Bonus ($) (2) | Stock Awards ($) (3) | Option Awards ($) (3) | Non- Equity Incentive Plan Compen- sation ($) (4) | Non- Qualified Deferred Compen- sation Earnings ($) (5) | All Other Compen- sation ($) (6) | Total ($) | |||||||||||||||||||||||||||

| Rex L. Smith, III | 2015 | 390,000 | — | — | 147,510 | 58,500 | — | 26,984 | 622,994 | |||||||||||||||||||||||||||

| President and Chief Executive Officer | 2014 | 375,000 | 100,000 | — | — | — | — | 22,329 | 497,329 | |||||||||||||||||||||||||||

| 2013 | 325,000 | — | 71,500 | — | — | — | 18,338 | 414,838 | ||||||||||||||||||||||||||||

| Bruce E. Thomas | 2015 | 198,000 | — | — | 39,336 | 19,800 | 11,127 | 16,339 | 284,602 | |||||||||||||||||||||||||||

| Executive Vice President and Chief Financial Officer | 2014 | 191,000 | — | — | 25,945 | 13,500 | 140,726 | 14,968 | 386,139 | |||||||||||||||||||||||||||

| 2013 | 185,000 | — | — | 17,331 | 13,875 | 9,165 | 13,998 | 239,369 | ||||||||||||||||||||||||||||

| Jeff R. Cantrell | 2015 | 198,000 | — | — | 39,336 | 19,800 | — | 16,830 | 273,966 | |||||||||||||||||||||||||||

| Executive Vice President and Chief Operating Officer, Essex Bank | 2014 | 191,000 | — | — | 25,945 | 13,500 | — | 18,691 | 249,136 | |||||||||||||||||||||||||||

| 2013 | 180,000 | — | — | 17,331 | 14,400 | — | 15,542 | 227,273 | ||||||||||||||||||||||||||||

| John M. Oakey, III | 2015 | 198,000 | — | — | 39,336 | 19,800 | — | 9,084 | 266,220 | |||||||||||||||||||||||||||

| Executive Vice President, General Counsel and Secretary | 2014 | 191,000 | — | — | 25,945 | 13,500 | — | 8,178 | 238,623 | |||||||||||||||||||||||||||

| 2013 | 185,000 | — | — | 17,331 | 13,875 | — | 8,391 | 224,597 | ||||||||||||||||||||||||||||

| Patricia M. Vogel (1) | 2015 | 182,000 | — | — | 39,336 | 18,200 | — | 14,740 | 254,276 | |||||||||||||||||||||||||||

| Executive Vice President and Chief Credit Officer, Essex Bank | 2014 | 165,477 | — | — | 17,297 | 12,500 | — | 13,519 | 208,793 | |||||||||||||||||||||||||||

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) (1) | Non-Equity Incentive Plan Compen- sation ($) (2) | Change in Qualified Deferred Compen-sation Earnings ($) (3) | All Other Compen-sation ($) (4) | Total ($) |

Rex L. Smith, III President and Chief Executive Officer | 2019 2018 2017 | 427,500 420,000 410,000 | -- -- -- | -- -- -- | 167,000 146,000 234,000 | 86,569 99,225 47,638 | -- -- -- | 269,288 277,449 214,973 | 950,357 942,674 906,611 |

Bruce E. Thomas Executive Vice President and Chief Financial Officer | 2019 2018 2017 | 219,000 215,000 210,000 | -- -- -- | -- -- -- | 83,500 73,000 62,400 | 29,565 33,863 16,267 | 134,450 13,907 76,199 | 45,749 48,637 32,723 | 512,264 384,407 397,589 |

Jeff R. Cantrell Executive Vice President and Chief Operating Officer, Essex Bank | 2019 2018 2017 | 220,000 215,000 210,000 | -- -- -- | -- -- -- | 83,500 73,000 62,400 | 29,700 33,863 16,267 | -- -- -- | 60,215 59,461 43,946 | 393,415 381,324 332,613 |

Patricia M. Davis Executive Vice President and Chief Credit Officer, Essex Bank | 2019 2018 2017 | 210,000 203,000 197,000 | -- -- -- | -- -- -- | 83,500 73,000 62,400 | 28,350 31,973 15,260 | -- -- -- | 47,874 49,344 33,972 | 369,724 357,317 308,632 |

John M. Oakey, III Executive Vice President, General Counsel and Secretary | 2019 2018 2017 | 219,000 215,000 210,000 | -- -- -- | -- -- -- | 83,500 73,000 62,400 | 29,565 33,863 16,267 | -- -- -- | 51,254 52,875 36,610 | 383,319 374,738 325,277 |

| These amounts reflect the aggregate grant date fair values of each award as computed in accordance with FASB ASC Topic 718. The fair value of each option award is estimated on the date of grant using the “Black Scholes Option Pricing” method. Additional information, including a discussion of the assumptions used for the estimates, is in Note |

| These amounts reflect pay-outs under the Company’s objectives-based incentive plan. Additional information on this plan is included in the “Compensation Program – Annual Incentives” section above. |

| The amount for |

| Amounts for |

Employment Agreements

The Company has an employment agreement with Bruce E. Thomas. The Company does not currently have employment agreements with any of its other executive officers.

The agreement Information with Bruce E. Thomas became effective as of May 31, 2008, which wasrespect to the effective date of the merger of the Company and BOE Financial. Effective as of that date and pursuant to his employment agreement, Mr. Thomas serves as the Company’s Chief Financial Officer, at a salary determined by the Company’s Board of Directors. The initial term of the employment agreement was for three years after the merger date. On each anniversary of the merger date, upon the review and approval of the Board of Directors, the term of the agreement is extended by an additional year unless the Company or Mr. Thomas gives written notice at least 30 days prior to an anniversary date that no further extensions should occur.

The employment agreement with Mr. Thomas imposes certain limitations on him, precluding him from soliciting the Company’s or the Bank’s employees and customers and, without the Company’s prior written consent, competing with the Company or the Bank by forming, serving as an organizer, director, officer or consultant to, or maintaining a more than one percent passive investment in a depository financial institution or holding company if such entity has one or more offices or branches located within a 10-mile radius of the headquarters or any branch banking office of the Company or the Bank. These limitations will be for a period of two years from the date on which Mr. Thomas ceases to be an employee of the Company except that, in the case of a termination without cause or for good reason following a change in control the non-compete and customer solicitation restrictions will be in force for only one year.

Mr. Thomas’s employment agreement addresses termination of his employment under various termination scenarios. Information on these termsagreements is providedset forth in the “Post-Employment Compensation” section below.

Pay Ratio Disclosure

For the year ended December 31, 2019, the total compensation for Rex L. Smith, III, the Company’s President and Chief Executive Officer, was $950,357, as presented in the “Summary Compensation Table” above. For the same period, the median of the total compensation of all employees of the Company was $50,197. Accordingly, the ratio of the total compensation of Mr. Smith to the median employee for the 2019 year was 18.93 to 1.

The Company identified the median employee based on a review of the total compensation, as calculated in the same manner for the President and Chief Executive Officer, for the year ended December 31, 2019 of each of the 254 employees who were employed in a full-time or part-time capacity by the Company as of December 31, 2019.

The rules for identifying the median employee and calculating the pay ratio based on that employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions and to make reasonable estimates and assumptions that reflect their compensation practices. As such, the pay ratio reported by other companies may not be comparable to the pay ratio reported above, as other companies may have different employment and compensation practices and may utilize different methodologies, exclusions, estimates and assumptions in calculating their own pay ratios.

Grants of Plan-Based Awards

The following table shows potential annual performance-based cash bonuses and awards of restricted stock and non-statutory stock options under the Company’s 2009 Stock Incentive Plan during the year ended December 31, 2015.2019. The Company did not grant any stock awards under either its 2009 Stock Incentive Plan or its 2019 Stock Incentive Plan during the year.

| Estimated Possible Payouts Under Non-Equity Incentive Plan Awards (1) | All Other Stock Awards: | All Other Option Awards: | Exercise | Grant Date Fair | ||||||||||||||||||||||||||||

| Name | Grant Date | Threshold ($) | Target ($) | Maximum ($) | Number of Shares of Stock or Units (#) | Number of Securities Underlying Options (#) (2) | or Base Price of Option Awards ($/Sh) | Value of Stock and Option Awards ($) (3) | ||||||||||||||||||||||||

| Smith | 1/16/2015 | — | — | — | — | 75,000 | 4.37 | 147,510 | ||||||||||||||||||||||||

| — | 29,250 | 58,500 | 146,250 | — | — | — | — | |||||||||||||||||||||||||

| Thomas | 1/16/2015 | — | — | — | — | 20,000 | 4.37 | 39,336 | ||||||||||||||||||||||||

| — | 9,900 | 19,800 | 49,500 | — | — | — | — | |||||||||||||||||||||||||

| Cantrell | 1/16/2015 | — | — | — | — | 20,000 | 4.37 | 39,336 | ||||||||||||||||||||||||

| — | 9,900 | 19,800 | 49,500 | — | — | — | — | |||||||||||||||||||||||||

| Oakey | 1/16/2015 | — | — | — | — | 20,000 | 4.37 | 39,336 | ||||||||||||||||||||||||

| — | 9,000 | 19,800 | 49,500 | — | — | — | — | |||||||||||||||||||||||||

| Vogel | 1/16/2015 | — | — | — | — | 20,000 | 4.37 | 39,336 | ||||||||||||||||||||||||

| — | 9,100 | 18,200 | 45,500 | — | — | — | — | |||||||||||||||||||||||||

| All Other | ||||||||||||||||||||||

| Option | Grant | |||||||||||||||||||||

| Awards: | Exercise | Date Fair | ||||||||||||||||||||

| Number of | or Base | Value of | ||||||||||||||||||||

| Estimated Possible Payouts Under | Securities | Price of | Stock and | |||||||||||||||||||

| Non-Equity Incentive Plan Awards (1) | Underlying | Option | Option | |||||||||||||||||||

| Grant | Threshold | Target | Maximum | Options | Awards | Awards | ||||||||||||||||

| Name | Date | ($) | ($) | ($) | (#) (2) | ($/Sh) | ($) (3) | |||||||||||||||

| Smith | 1/18/2019 | -- | -- | -- | 50,000 | 7.70 | 167,000 | |||||||||||||||

| -- | 32,063 | 64,125 | 160,313 | -- | -- | -- | ||||||||||||||||

| Thomas | 1/18/2019 | -- | -- | -- | 25,000 | 7.70 | 83,500 | |||||||||||||||

| -- | 10,950 | 21,900 | 54,750 | -- | -- | -- | ||||||||||||||||

| Cantrell | 1/18/2019 | -- | -- | -- | 25,000 | 7.70 | 83,500 | |||||||||||||||

| -- | 11,000 | 22,000 | 55,000 | -- | -- | -- | ||||||||||||||||

| Davis | 1/18/2019 | -- | -- | -- | 25,000 | 7.70 | 83,500 | |||||||||||||||

| -- | 10,500 | 21,000 | 52,500 | -- | -- | -- | ||||||||||||||||

| Oakey | 1/18/2019 | -- | -- | -- | 25,000 | 7.70 | 83,500 | |||||||||||||||

| -- | 10,950 | 21,900 | 54,750 | -- | -- | -- | ||||||||||||||||

| (1) | For the |

| (2) | All option awards presented vest in four equal annual installments beginning on the first anniversary of the grant date. |

| (3) | These amounts reflect the aggregate grant date fair values of each award as computed in accordance with FASB ASC Topic 718. The fair value of each option award is estimated on the date of grant using the “Black Scholes Option Pricing” method. Additional information, including a discussion of the assumptions used for the estimates, is in Note |

Outstanding Equity Awards

In 2009, theThe Company adoptedmaintains the Community Bankers Trust Corporation 2009 Stock Incentive Plan.Plan, which terminated on June 17, 2019, and the Community Bankers Trust Corporation 2019 Stock Incentive Plan, which was approved by shareholders on May 17, 2019. The 2019 plan is tocan be used (and before its termination the 2009 plan was used) to grant restricted stock awards, stock options in the form of incentive stock options and non-statutory stock options stock appreciation rights and other stock-based awards to employees and

directors of the Company. As adopted,The 2009 plan made available up to 2,650,000 shares of common stock for issuance to participants under the plan, and the 2019 plan makes available up to 2,650,0002,500,000 shares of common stock for issuance to participants under the plan.

The following table shows outstanding stock awards and option awards held by the named executive officers as of December 31, 2015.2019. The Company has not adopted an objectives-based equity incentive plan under which it makes option awards or stock awards.

| Options Awards | Stock Awards | Options Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||||||

| Number of | Number of | Number of | Market Value | Number of | Number of | Number of | Market Value | |||||||||||||||||||||||||||||||||||||

| Securities | Securities | Shares or | of Shares or | Securities | Securities | Shares or | of Shares or | |||||||||||||||||||||||||||||||||||||

| Underlying | Underlying | Units | Units of | Underlying | Underlying | Units of | Units of | |||||||||||||||||||||||||||||||||||||

| Unexercised | Unexercised | of Stock That | Stock That | Unexercised | Unexercised | Stock That | Stock That | |||||||||||||||||||||||||||||||||||||

| Options | Options | Option | Option | Have Not | Have Not | Options | Options | Option | Option | Have Not | Have Not | |||||||||||||||||||||||||||||||||

| (#) | (#) | Exercise Price | Expiration | Vested | Vested | (#) | (#) | Exercise Price | Expiration | Vested | Vested | |||||||||||||||||||||||||||||||||

| Name | Exercisable | Unexercisable | ($) | Date | (#) | ($) | Exercisable | Unexercisable | ($) | Date | (#) | ($) | ||||||||||||||||||||||||||||||||

| Smith | — | — | — | — | 12,500 | (7) | 67,125 | 50,000 | -- | 1.25 | 10/20/2021 | -- | -- | |||||||||||||||||||||||||||||||

| 15,000 | 5,000 | (1) | 2.78 | 5/20/2020 | — | — | 75,000 | -- | 4.37 | 1/16/2025 | -- | -- | ||||||||||||||||||||||||||||||||

| 50,000 | — | 1.25 | 10/20/2021 | — | — | 30,000 | 10,000 | (1) | 5.07 | 1/22/2026 | -- | -- | ||||||||||||||||||||||||||||||||

| — | 75,000 | (2) | 4.37 | 1/16/2025 | 37,500 | 37,500 | (2) | 7.40 | 1/20/2027 | -- | -- | |||||||||||||||||||||||||||||||||

| 10,000 | 30,000 | (3) | 8.45 | 1/19/2028 | -- | -- | ||||||||||||||||||||||||||||||||||||||

| -- | 50,000 | (4) | 7.70 | 1/18/2029 | -- | -- | ||||||||||||||||||||||||||||||||||||||

| Thomas | 20,000 | — | 2.78 | 5/20/2020 | — | — | 3,750 | -- | 3.80 | 1/17/2024 | -- | -- | ||||||||||||||||||||||||||||||||

| 12,500 | 6,250 | (3) | 1.25 | 1/19/2022 | — | — | 10,000 | -- | 4.37 | 1/16/2025 | -- | -- | ||||||||||||||||||||||||||||||||

| 7,500 | 7,500 | (4) | 2.86 | 1/17/2023 | — | — | 10,000 | 5,000 | (1) | 5.07 | 1/22/2026 | -- | -- | |||||||||||||||||||||||||||||||

| 3,750 | 11,250 | (5) | 3.80 | 1/17/2024 | — | — | 10,000 | 10,000 | (2) | 7.40 | 1/20/2027 | -- | -- | |||||||||||||||||||||||||||||||

| — | 20,000 | (2) | 4.37 | 1/16/2025 | 5,000 | 15,000 | (3) | 8.45 | 1/19/2028 | -- | -- | |||||||||||||||||||||||||||||||||

| -- | 25,000 | (4) | 7.70 | 1/18/2029 | -- | -- | ||||||||||||||||||||||||||||||||||||||

| Cantrell | 6,000 | — | 2.78 | 5/20/2020 | — | — | 15,000 | 5,000 | (1) | 5.07 | 1/22/2026 | -- | -- | |||||||||||||||||||||||||||||||

| 10,000 | 10,000 | (2) | 7.40 | 1/20/2027 | -- | -- | ||||||||||||||||||||||||||||||||||||||

| 5,000 | 15,000 | (3) | 8.45 | 1/19/2028 | -- | -- | ||||||||||||||||||||||||||||||||||||||

| -- | 25,000 | (4) | 7.70 | 1/18/2029 | -- | -- | ||||||||||||||||||||||||||||||||||||||

| Davis | 10,000 | -- | 1.25 | 1/19/2022 | -- | -- | ||||||||||||||||||||||||||||||||||||||

| 10,000 | -- | 2.86 | 1/17/2023 | -- | -- | |||||||||||||||||||||||||||||||||||||||

| 10,000 | -- | 3.80 | 1/17/2024 | -- | -- | |||||||||||||||||||||||||||||||||||||||

| 6,750 | 2,250 | (3) | 1.25 | 1/19/2022 | — | — | 20,000 | -- | 4.37 | 1/16/2025 | -- | -- | ||||||||||||||||||||||||||||||||

| 8,250 | 2,750 | (6) | 1.97 | 7/30/2022 | — | — | 15,000 | 5,000 | (1) | 5.07 | 1/22/2026 | -- | -- | |||||||||||||||||||||||||||||||

| 7,500 | 7,500 | (4) | 2.86 | 1/17/2023 | — | — | 10,000 | 10,000 | (2) | 7.40 | 1/20/2027 | -- | -- | |||||||||||||||||||||||||||||||

| 3,750 | 11,250 | (5) | 3.80 | 1/17/2024 | — | — | 5,000 | 15,000 | (3) | 8.45 | 1/19/2028 | -- | -- | |||||||||||||||||||||||||||||||

| — | 20,000 | (2) | 4.37 | 1/16/2025 | -- | 25,000 | (4) | 7.70 | 1/18/2029 | -- | -- | |||||||||||||||||||||||||||||||||

| Oakey | 20,000 | — | 2.78 | 5/20/2020 | — | — | 25,000 | -- | 1.25 | 1/19/2022 | -- | -- | ||||||||||||||||||||||||||||||||

| 18,750 | 6,250 | (3) | 1.25 | 1/19/2022 | — | — | 15,000 | -- | 2.86 | 1/17/2023 | -- | -- | ||||||||||||||||||||||||||||||||

| 7,500 | 7,500 | (4) | 2.86 | 1/17/2023 | — | — | 15,000 | -- | 3.80 | 1/17/2024 | -- | -- | ||||||||||||||||||||||||||||||||

| 3,750 | 11,250 | (5) | 3.80 | 1/17/2024 | — | — | 20,000 | -- | 4.37 | 1/16/2025 | -- | -- | ||||||||||||||||||||||||||||||||

| — | 20,000 | (2) | 4.37 | 1/16/2025 | 15,000 | 5,000 | (1) | 5.07 | 1/22/2026 | -- | -- | |||||||||||||||||||||||||||||||||

| Vogel | 7,500 | 2,500 | (3) | 1.25 | 1/19/2022 | — | — | |||||||||||||||||||||||||||||||||||||

| 5,000 | 5,000 | (4) | 2.86 | 1/17/2023 | — | — | 10,000 | 10,000 | (2) | 7.40 | 1/20/2027 | -- | -- | |||||||||||||||||||||||||||||||

| 2,500 | 7,500 | (5) | 3.80 | 1/17/2024 | — | — | 5,000 | 15,000 | (3) | 8.45 | 1/19/2028 | -- | -- | |||||||||||||||||||||||||||||||

| — | 20,000 | (2) | 4.37 | 1/16/2025 | -- | 25,000 | (4) | 7.70 | 1/18/2029 | -- | -- | |||||||||||||||||||||||||||||||||

| (1) | The options |

| (2) | The options vest in four equal annual installments beginning on January |

| (3) | The options vest in four equal annual installments beginning on January 19, |

| (4) | The options vest in four equal annual installments beginning on January |

Option Exercises and Stock Vested

The following table shows the exercise of stock options and the vesting of restricted stock awards by the named executive officers during the year ended December 31, 2015.2019. No restricted stock awards held by any such officers vested during the year ended December 31, 2019, and there are no such outstanding awards.

| Option Awards | Stock Awards | |||||||||||||||

| Number of Shares | Value Realized on | Number of Shares | Value Realized on | |||||||||||||

| Acquired on Exercise | Exercise | Acquired on Vesting | Vesting | |||||||||||||

| Name | (#) | ($) | (#) (1) | ($) | ||||||||||||

| Smith | — | — | 6,250 | 27,313 | ||||||||||||

| Thomas | — | — | — | — | ||||||||||||

| Cantrell | — | — | — | — | ||||||||||||

| Oakey | — | — | — | — | ||||||||||||

| Vogel | — | — | — | — | ||||||||||||

| Option Awards | |||||||

| Number of Shares | Value Realized on | ||||||

| Acquired on Exercise | Exercise | ||||||

| Name | (#) | ($) | |||||

| Smith | 20,000 | 118,200 | |||||

| Thomas | -- | -- | |||||

| Cantrell | 50,000 | 208,221 | |||||

| Davis | -- | -- | |||||

| Oakey | 20,000 | 95,806 | |||||

Post-Employment Compensation

401(k) Employee Savings Plan

The Company sponsors a 401(k) plan for all of its eligible employees. The executive officers of the Company participate in the 401(k) plan on the same basis as all other eligible employees of the Company.

Pension Plan and Supplemental Executive Retirement Plan

The Bank maintains a non-contributory defined benefit pension plan for all full-time employees who are 21 years of age or older and who have completed one year of eligibility service. The plan, which was a benefit available only to employees of the Bank prior to the merger of BOE Financial with and into the Company, was frozen to new entrants prior to the merger. Effective December 31, 2010, the Company froze the plan benefits for all participants in the pension plan.

Mr. Thomas is a participant in this plan. Benefits payable under the plan are based on years of credited service, average compensation over the highest consecutive five years, and the plan’s benefit formula (1.60% of average compensation times years of credited service up to 20 years, plus 0.75% of average compensation times years of credited service in excess of 20 years, plus 0.65% of average compensation in excess of Social Security Covered Compensation times years of credited service up to a maximum of 35 years). For 2015,2019, the maximum allowable annual benefit payable by the plan at age 65 (the plan’s normal retirement age) was $210,000$225,000 and the maximum compensation covered by the plan was $265,000.$280,000. Reduced early retirement benefits are payable on or after age 55 upon completion of 10 years of credited service. Amounts payable under the plan are not subject to reduction for Social Security benefits.